Everywhere we turn, there is poverty. Yet we are told to “pull ourselves together” because things will eventually get better. But in reality, it is their lives and the lives of their loved ones that are improving not ours. What they don’t say is that our future has been mortgaged by huge debt. Their lies cut too deep; the ground beneath us, our elections, and our hopes were rigged. I weep for my country, Nigeria.

Poverty in Nigeria is not random; it is engineered. It functions as a system where deprivation is monetized. Those at the bottom are locked out of wealth, while those in power profit. The previous administration’s slogan was change, and this trend has continued in the present administration. Now they even tell us to “protect ourselves against terrorists.” But with what? When almost everyone in Nigeria struggles to afford even one meal a day? Poverty here isn’t an accident; it’s a system. And while we struggle, someone else is cashing the check.

Until we see their children attend the same schools as ours and use the same hospitals, governance will remain an instrument of self-preservation for the ruling class. Until the President begins to use public hospitals, the promise of change will remain incomplete. Until the President directs the EFCC to investigate ministers and government officials with mansions worth millions of dollars, reforms will remain cosmetic designed only to keep the poor in perpetual pain. Until the government drastically reduces the obscene salaries and allowances of public officials, “change” will continue to burden the masses while enriching the political elite who ruined Nigeria in the first place.

Borrowing has become a recurring feature of many developing nations’ economies, and Nigeria is no exception. While loans can, in theory, provide capital for development, the reality has been starkly different. For Nigeria, debt has too often translated into a debt overhang a heavy financial burden that discourages investment, drains public resources, and undermines long-term growth.

A large debt stock makes investors wary, fearing that profits from new ventures will be taxed away to service old loans. This fear, coupled with mounting interest obligations, leaves fewer resources for essential services such as health and education. According to international observers like the World Bank, Nigeria remains a lower-middle-income country despite its wealth of natural resources. Mismanagement, corruption, inadequate infrastructure, political instability, and widespread poverty have held back its transition to real development.

Developing and underdeveloped countries often borrow at higher interest rates than their developed counterparts, intensifying debt service obligations. The result is a vicious cycle: other governments spend more than 10% of their revenues on interest payments alone, but in Nigeria’s case, it is much higher, leaving little for schools, hospitals, or investment in human capital.

Olusegun Obasanjo (1999–2007): In 2005, his administration negotiated a landmark debt relief deal with the Paris Club. Nigeria secured the cancellation of $18 billion in debt, paying $12 billion to clear the balance. By 2007, external debt stood at just $2.11 billion—a remarkable turnaround from the $28 billion inherited.

Umaru Musa Yar’Adua (2007–2010): His government maintained a cautious borrowing strategy. External debt rose modestly to $3.50 billion, largely through concessional loans for education, health, and infrastructure. Sustainability remained a priority.

Goodluck Jonathan (2010–2015): Debt nearly doubled to $7.30 billion. His administration borrowed heavily for infrastructure roads, power projects, and railways. However, corruption and weak monitoring mechanisms hampered impact, with many funds misappropriated and projects stalled.

Muhammadu Buhari (2015–2023): Nigeria’s debt ballooned from $10.3 billion to $42.9 billion—a staggering $32.6 billion increase, the largest since 1999. Falling oil revenues and chronic budget deficits drove borrowing, but corruption, inflated contracts, and incomplete projects plagued the administration. Debt servicing obligations choked public finances, leaving little for genuine development.

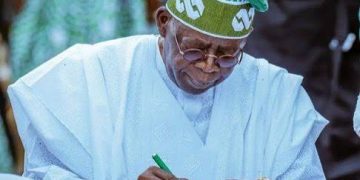

Bola Ahmed Tinubu (2023–Present): In just over a year, Tinubu has added $10.23 billion to external debt, bringing it to $53.13 billion by December 2024. His borrowing includes $6.45 billion from the World Bank for power and education, $1.57 billion for healthcare and irrigation, and $2.2 billion to plug the 2024 budget deficit. Recently, the Senate approved his request for over $21 billion in fresh foreign loans to cover shortfalls in the 2025 budget.

While these loans are presented as investments in reforms and growth, critics warn that entrenched corruption, nepotism, and inflated contracts will sabotage their effectiveness.

Public schools remain chronically underfunded, depriving millions of children of quality education. Meanwhile, private schools, education technology firms, and businesses owned by the elite thrive. They strip resources from public education, then blame ordinary Nigerians for underachievement. Poverty, in this way, becomes a revenue stream.

Those in power, critics argue, fear an educated populace capable of exposing uncomfortable truths. As a result, ignorance is weaponized as a tool of control, and poverty becomes a political strategy.

Borrowing becomes destructive when loans fund recurrent expenses or are mismanaged, rather than being channeled into productive investments in infrastructure and human capital. This kind of debt mortgages the future, reduces fiscal stability, fuels inflation, and ultimately erodes public trust.

Nigeria’s path forward requires breaking this cycle of debt dependence by building wealth at the community level, investing in human capital, and preserving culture. Equally important is demanding accountability from leaders and insisting that borrowed funds translate into real, measurable development.

Because in the end, every system has a winner. The question is: will it continue to be the few who profit from Nigeria’s poverty, or the millions who deserve to see the promise of true prosperity?

About the Author

Daniel Okonkwo is a seasoned writer, human rights advocate, and public affairs analyst, renowned for his thought-provoking articles on governance, justice, and social equity. Through his platform, Profiles International Human Rights Advocate, he consistently sheds light on pressing issues affecting Nigeria and beyond, amplifying voices that call for accountability and reform. He is also a professional transcriptionist and experienced petition writer, with over 1,000 published articles to his credit on Google. Many of his works have been featured in Sahara Reporters and other major news outlets. In addition, he works as a ghostwriter, freelancer, and journalist.